With climate- and sustainability-related legislation in some jurisdictions—like the EU—making efforts to catch up, how does CDP compare?

In this article, we’re answering the questions:

- Do some of these more sweeping regulations overlap with CDP? How?

- How can companies take advantage of these overlaps and maximize how efficient their efforts are?

CDP and the CSRD

Passed in 2022, the Corporate Sustainability Reporting Directive (CSRD) is an EU-specific mandate that requires qualifying EU businesses to report on material ESG topics. Unlike CDP—which is entirely voluntary—the CSRD, which is being rolled out beginning in 2025, is mandatory for in-scope companies. These companies include entities based in the EU or with revenues in the EU above a certain threshold. (See our article on the topic for more details.)

CDP and the CSRD both cover environmental, social, and governance topics, and both were created with the intent of providing better transparency and more detailed ESG information for investors and other stakeholders. Unlike CDP responders, companies reporting in line with the CSRD do not receive a performance score.

Reporting requirements and assurance

Both CDP and the CSRD cover a broad range of topics, including climate change, forests, water, value chain impacts, and governance. Reporting companies are also expected to disclose how they evaluate and manage sustainability-related risks and opportunities, strategy, and governance.

- CDP’s full corporate questionnaire is composed of thirteen modules, including those related to risks and opportunities, governance, business strategy, and specific environmental topics such as climate change, forests, water security, plastics, and biodiversity. Certain questions may or may not be included depending on the size of your organization (full questionnaire vs SME questionnaire) and your industry.

- The CSRD includes multiple frameworks focusing on individual sections of sustainability, such as climate change, pollution, water and marine pollution, biodiversity and ecosystems, the circular economy, workforce, and value chain workers.

Assurance requirements for CSRD are not yet clearly defined yet. Currently, limited assurance is required from the first year of reporting, with a higher level of assurance (reasonable assurance) feasible in the near future. Limited assurance of information provided in reporting should be conducted by statutory auditors or independent assurance services providers. In addition, assurance providers must apply European assurance standards as well as the requirements set out in the EU Audit Regulation and Directive (see guidelines on limited assurance on sustainability reporting).

CDP requires third-party verification for 100% of scope 1 and 2 emissions if a company is to be awarded Leadership points. Verification is required for at least 70% of scope 3 emissions. CDP’s methodology currently does not differentiate between limited and reasonable assurance.

Alignment

For years, CDP has been working to integrate best practice sustainable reporting criteria into its methodology. This helps simplify reporting and also puts companies disclosing to CDP in an advantageous position: they are better equipped to take on more stringent reporting regulations, should they arise.

CDP’s corporate questionnaire aligns with the International Financial Reporting Standards (IFRS) S2 climate standard and the recommendations set forth by the Task Force on Climate-related Financial Disclosures (TCFD). As such, companies that report environmental data through CDP will be well prepared to disclose in line with any other frameworks that interact with IFRS S2 and the TCFD—including the European Sustainability Reporting Standards (ESRS) E1 requirements, which dictate reporting requirements under the CSRD.

CDP has also stated that it is committed to integrating sustainable finance taxonomy criteria into its disclosure system. Its questionnaire pilots taxonomy questions on EU Taxonomy objectives and collects data on companies’ eligibility and financial accounting alignment.

CDP and California’s Climate Accountability Package

In late 2023, the state of California signed two climate-related bills into law, collectively known as the Climate Accountability Package:

- The Climate Corporate Data Accountability Act (CCDAA, SB 253), which provides the framework for disclosure of GHG emissions data

- The Climate-Related Financial Risk Act (CRFRA, SB 261), which outlines guidelines for public disclosure of climate-related financial risk

SB 261 and SB 253 apply to companies based in the state of California or with annual revenues in California above a certain threshold—$500 million for SB 261 and $1 billion for SB 253. Like CDP’s questionnaire, California’s climate bills were created to provide more detailed climate-related information for investors and other stakeholders. Like the CSRD, these bills mandate the disclosure of climate-related data for companies that fall within its scope.

Reporting requirements and assurance

As with CSRD requirements, California’s Climate Accountability Package does overlap with CDP to some degree, and companies already reporting to CDP will find themselves well prepared to tackle reporting under SB 261 and SB 253.

SB 261 requires companies within its scope to prepare a climate-related financial risk report once every two years. The report should:

- disclose the company’s climate-related financial risk, in alignment with the TCFD’s recommendations

- disclose measures adopted to reduce and adapt to that risk

- explain any reporting gaps and describe plans to address them

- be publicly available on the company’s website

SB 253 requires the California Air Resources Board (CARB) to develop and adopt a regulation for the public disclosure of GHG emissions from companies within its scope. Scope 1 and 2 disclosures will be required starting in 2026, with scope 3 requirements beginning in 2027.

SB 261 does not include an assurance requirement. SB 253 requires reporting entities to obtain independent third-party assurance from providers with significant experience in measuring, analyzing, and reporting GHG emissions. SB 253 also directs CARB to establish a limited assurance standard for scope 3 emissions beginning in 2030, with scope 1 and 2 emissions likely to fall under a reasonable assurance engagement. CDP responders at Leadership levels should already be reporting third-party verified scope 1 and 2 emissions, as well as majority verified scope 3 emissions.

Alignment

SB 261 requires that a reporting company’s risk report align with the TCFD’s recommendations.

The reporting criteria outlined SB 253 are primarily based on the GHG Protocol and Corporate Value Chain (Scope 3) Accounting and Reporting Standard established by the World Resources Institute and World Business Council for Sustainable Development.

CDP and the ISSB’s IFRS S1 and S2

The IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and S2 (Climate-related Disclosures) standards were developed by the International Sustainability Standards Board with the hope of establishing a streamlined, unified language for reporting sustainability data. The IFRS S1 and S2 are not mandatory reporting requirements set forth by a governing body—rather, they are a unified set of standards that serves as a guide for other reporting regulations, platforms, and frameworks.

IFRS standards align with other standards like those created by the Climate Disclosure Standards Board (CDSB), the Task Force for Climate-related Financial Disclosures (TCFD), the Value Reporting Foundation’s Integrated Reporting Framework, and the Sustainability Accounting Standards Board (SASB). In fact, in 2024 CDP updated its methodology to align with IFRS S2.

Reporting requirements, assurance, and alignment

IFRS S2 specifies what companies should report in terms of Governance, Strategy, and Risk and Opportunity Management, including the processes used to identify, assess and prioritize risks and opportunities, metrics and targets, including scope 1, 2, and 3 emissions. It fully incorporates, and builds from, the TCFD recommendations, to which CDP is already fully aligned.

As we’ve stated, companies disclosing to CDP must verify the environmental data they report in order to achieve Leadership levels and demonstrate their environmental leadership to stakeholders. Verification must be completed by an accredited third-party provider and according to recognized standards, to ensure these are broadly comparable. CDP’s accepted standards include a list of about forty standards, such as:

- AA1000AS (AccountAbility)

- California Mandatory GHG Reporting Regulations (CARB)

- Carbon Trust Standard

- IDW PS 821: IDW Prüfungsstandard: Grundsätze ordnungsmäßiger Prüfung oder prüferischer Durchsicht von Berichtenim Bereich der Nachhaltigkeit

- IDW AsS 821: IDW Assurance Standard: Generally Accepted Assurance Principles for the Audit or Review of Reports on Sustainability Issues

- ISO 14064-1

- ISO 14064-3

- Toitū Envirocare’s carbonreduce certification standard

Any third-party verification standard referenced in a company’s disclosure to CDP is assessed against its acceptability criteria, covering the standard’s relevance, competency, independence, terminology, methodology, and availability.

Unlike CDP, the IFRS Foundation itself does not require assurance from companies that use its Standards. Instead, it anticipates that jurisdictional regulators will require some level of assurance and allows those regulators to choose what level of assurance is required. Both IFRS S1 and S2 are designed for the reported information to be assurable.

Key takeaways

As we’ve seen, CDP shares a considerable amount of overlap with other global sustainability frameworks, aligning closely with widely used ESG standards. CDP sets a high bar, and reporting to voluntary platforms like CDP allows companies to demonstrate accountability, sound risk management, and sustainability leadership in the face of climate-related and environmental challenges. Voluntary disclosure can also help prepare reporting companies for mandatory reporting, as regulations worldwide begin to tighten.

That said, voluntary reporting and regulatory reporting are not currently a one-to-one match. Although CDP is constantly evolving with the release of new and updated methodology each year, companies should work with their legal teams to understand what their regulatory reporting obligations are and how to fulfill them. Similarly, while CDP does mandate assurance, other reporting regulations may require different levels of assurance. We recommend staying on top of regulations in your jurisdiction to ensure that your company is compliant.

Whether you’re preparing for voluntary or mandatory sustainability disclosure, here are some key steps to consider:

- Timing: Start early and stay consistent. Establish reporting and data collection protocols early (a year or two in advance, if possible) to ensure transparency and allow for detailed disclosure with the above frameworks.

- Assurance: Prioritize third-party assurance of reported data. Set up verification partnerships and create transparency in the data collection and reporting process.

- Resources: Allocate resources for your sustainability reporting program, including setting up proper data collection protocols and establishing stakeholder partnerships to ensure for ease of reporting in future years.

- Scope and coverage: Review the coverage of the CDP questionnaire and other applicable regulations to ensure all in-scope data is collected and traceable for verification purposes, in compliance with reporting bodies.

- People: Identify relevant ESG data control officers and compilers. Ensure that your company has roles dedicated to managing climate issues. These roles should be explicitly clarified, with their connection to managing ESG topics enshrined in role descriptions, mandates, and terms of reference.

- Materiality and climate risk: Perform a materiality and climate risk analysis. Identify your company’s exposure to climate risk and alignment with climate opportunities. Consider industry-specific and cross-industry metrics, and consider (and document) assumptions on items like macroeconomic trends, climate-related policies in your jurisdictions, and developments in technology. Understand your organization’s climate-material topics.

- Financial vs sustainability data: Understand the linkages between financial and ESG data. ESG disclosure standards and regulatory requirements are moving toward asking for greater transparency on companies’ financial ties with ESG topics, like the percentage of executive remuneration tied to climate considerations and the impact of climate risks on cash flows.

Frameworks compared

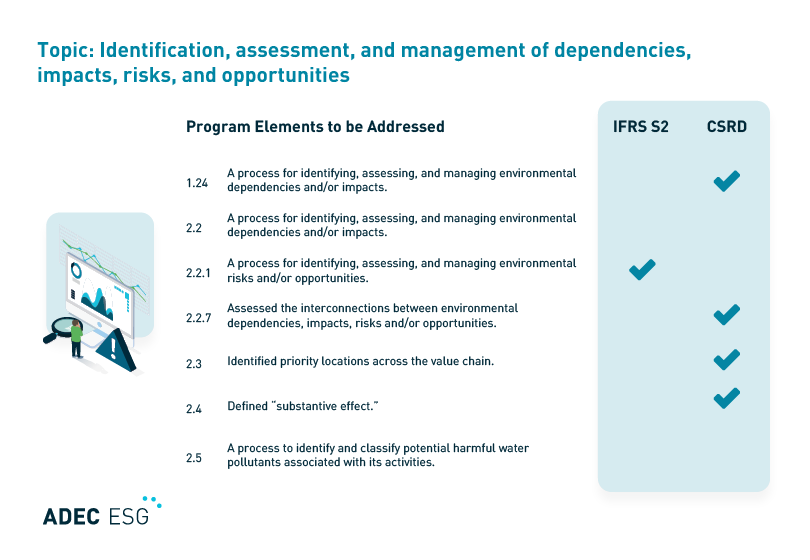

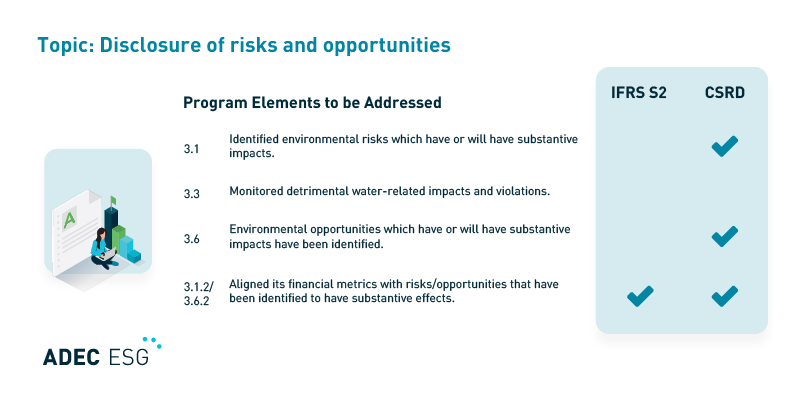

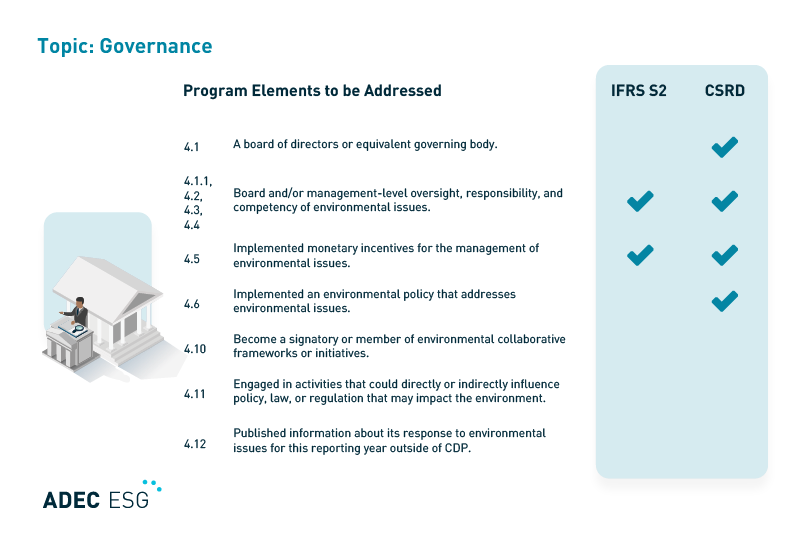

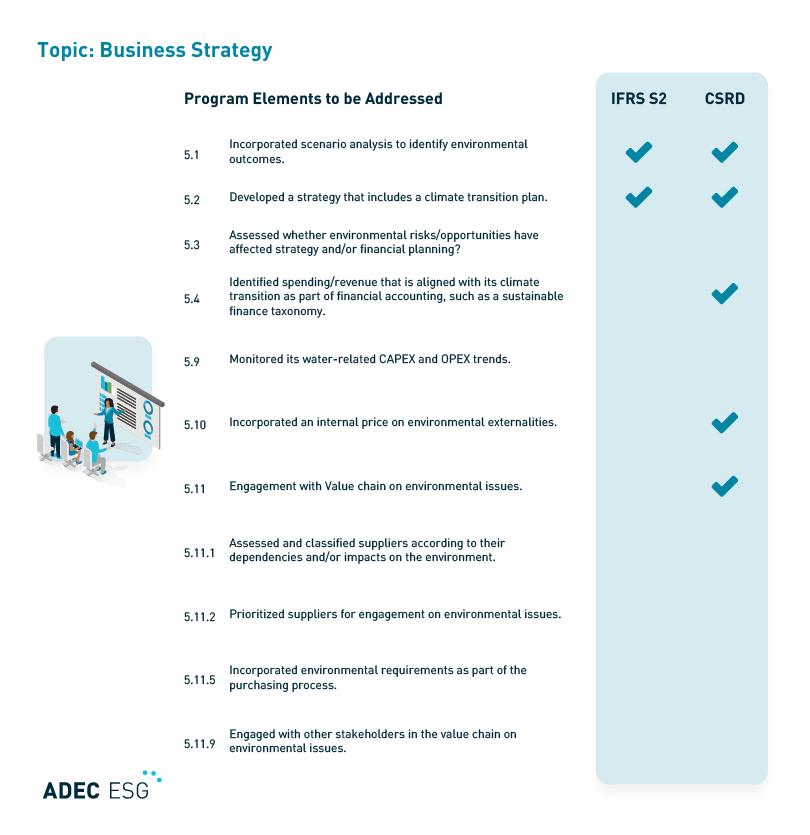

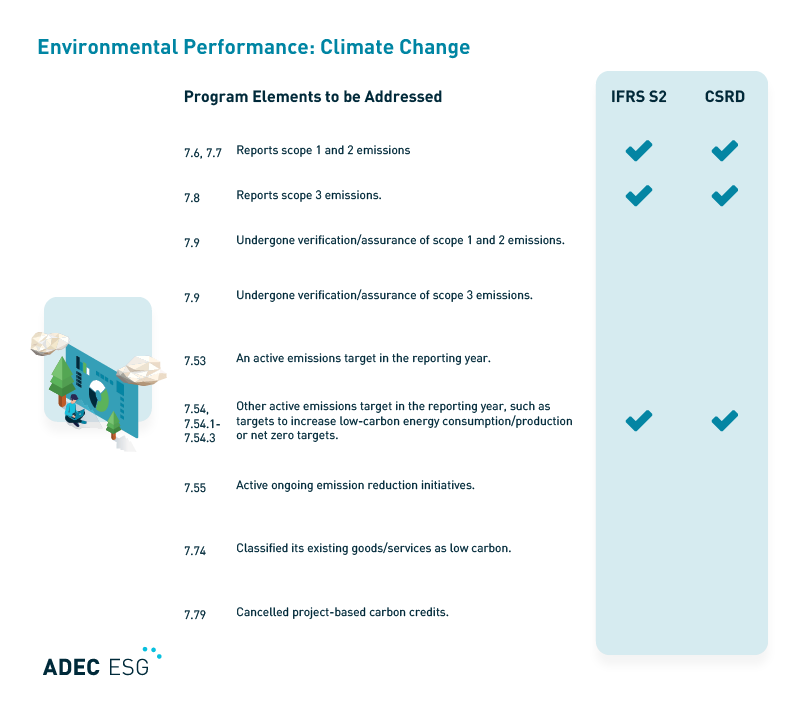

How does CDP’s questionnaire compare with IFRS S2 and the CSRD? Below, we break down how individual questions on the questionnaire connect to each framework.

Compare top frameworks

Download our free guide to the sustainability reporting frameworks compared in this article and simplify your disclosure with side-by-side comparisons.

ADEC ESG provides fully-integrated industry expertise, software solutions, and data management to organizations leading global, sustainable change. Our expert technical teams help companies around the world develop sustainability strategies, manage their ESG data, and report on their progress. Talk to us today to learn more about how we can help your company meet its sustainability goals.

This blog provides general information and does not constitute the rendering of legal, economic, business, or other professional services or advice. Consult with your advisors regarding the applicability of this content to your specific circumstances.