At the end of 2023, 4,205 companies and financial institutions received science-based target validation by the Science Based Targets initiative (SBTi), which was a 102% increase in validated targets compared to 2022. The Science Based Targets initiative is the corporate climate action organization that develops corporate standards, tools, and guidance to set greenhouse gas (GHG) emissions reductions targets.

In 2024, SBTi launched its Corporate Net-Zero Standard, offering updated guidelines to set a science- based target for all companies and sectors, except institutional investors, small and medium sized (SMEs) enterprises, and the fossil fuel sector. These organizations have separate guidance, including the Draft Financial Institution Net-Zero (FINZ) Standard, SME target-setting guidelines, and Guidance for the oil and gas sector. This article will focus on key elements of the Corporate Net-Zero Standard.

What are science-based targets?

Science-based targets (SBTs) mitigate GHG emissions in line with the Paris Agreement, which aims to limit global average temperatures by 1.5°C above pre-industrial levels. All SBTi-approved commitments and targets are published on the Target Dashboard. In addition to customers and suppliers asking companies to set science-based targets, new regulations from the European Union’s Corporate Sustainability Directive (CSRD) will require companies to disclose their climate-related targets as early as 2025.

Science-based targets vary by sector, company size, method, scope coverage, and level of ambition. GHG emissions are broken down into the following three scopes:

- Scope 1 emissions, which are the direct emissions owned or controlled by the company;

- Scope 2 emissions, which are the indirect emissions from purchased electricity, steam, heat, or cooling; and

- Scope 3 emissions, which are the indirect emissions within the company’s value chain.

Although it is not mandatory for SBTs to be net-zero targets, companies committing after July 2022 are required to align their SBTs with a 1.5°C pathway.

What does net-zero mean? What is a net-zero target?

The Net-Zero Standard defines corporate net zero as:

- Reducing scope 1, 2, and 3 emissions to zero or a residual level consistent with reaching net-zero emissions at the global or sector level in eligible 1.5°C-aligned pathways; and neutralizing any residual (or remaining) emissions at the net-zero target year and any GHG emissions released into the atmosphere thereafter via removal.

- Note: The term carbon neutral is different than net-zero. Carbon neutral allows counterbalancing emissions with carbon offsets, which are projects outside the value chain that remove or reduce carbon from the atmosphere. SBTi does not validate being carbon neutral because this method does not require corporate emission reductions.

A net-zero target is composed of the following three elements:

- Overarching net-zero target: the target statement that describes that the company will reach net-zero emissions across the value chain by a certain date

- Near-term targets: 5–10-year emission reduction targets in line with 1.5°C pathways

- Long-term targets: emission reduction targets that are achieved no later than 2050 and reduce emissions at the residual level line according to 1.5°C scenarios

In addition, companies are encouraged to take action and/or make investments outside of their own value chain, known as beyond value chain climate mitigation, to support societal net-zero goals.

Committing and submitting an SBT

Before committing to an SBT, companies first go through an internal approval process. This process involves analyzing the company’s full GHG emissions and meeting with essential stakeholders to discuss the feasibility of targets and what climate strategies are necessary. Although a commitment can be signed before developing a science-based target, many companies choose to develop the target first to identify the required emissions reductions and develop climate strategies that will help the company stay on track to achieving the target.

Once the company is ready to make its commitment, it will:

1. Register with SBTi Services, a subsidiary of the SBTi responsible for target validation, via the Validation Portal.

2. Make a science-based target commitment. (Committing before submitting a target is optional and can occur at the same time).

3. Submit a target within 24 months of the commitment date using the SBTi Services Corporate Target Submission Form here. This form is all-encompassing, asking a series of questions about company information, GHG inventory, target details, implementation, and reporting.

4. Check any emails from SBTi during the Technical Screening period, which is the period to verify the completeness and eligibility of the company’s submission. If the company does not pass the technical screening, it can make recommended changes and quickly resubmit the form to SBTi Services.

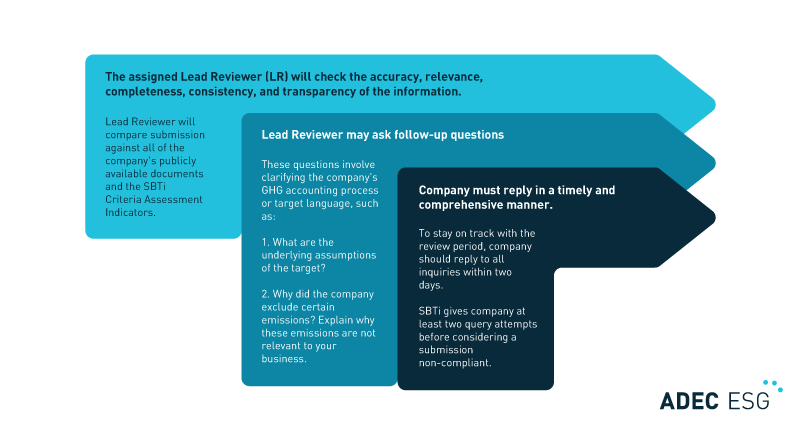

5. Respond to any queries from the Target Validation Team, which has 30 to 60 days to review the target submission after the technical screening period. This process is highlighted in detail below:

6. Once approved, communicate target to the public and disclose annual progress. Preparation for the announcement includes working with the SBTi Communications team on the materials and release date, which is usually one month after the decision is sent and no later than 6 months.

To learn more, visit the Procedure for Validation of SBTi Targets document.

Process for setting science-based targets

1. Select a base year

- Ensure the base year has verifiable scope 1, 2, and 3 emissions data and represents a typical business year (earliest year being 2015).

- Base year must be the same for near-term and long-term targets. A different base year can be used for Scope 3, but it is recommended to be the same for all near-term targets.

- When comparing targets with the same target year but different base years, the target with a later base year may require a higher year-over-year emissions reduction rate to “catch up” and still meet target year reductions in line with Paris Agreement ambition.

- If an organization finds a change in 5% of the organization’s total base year emissions (such as if it sells a company asset), then a recalculation is required.

2. Calculate your company’s emissions.

Before getting to the calculations, a company must develop its GHG inventory, which involves:

- Determining your company’s organizational boundary, which is the boundary of operations owned or controlled by the reporting company. The three approaches to consolidation are equity share, financial control, and operational control.

- Next, outline your operational boundary, which defines the scope of direct and indirect emissions that fall with your established organizational boundary.

- Once your organizational and operational boundaries are well defined, start calculating GHG emissions. When calculating total emissions, make sure to cover 95% of Scope 1 and 2 GHG emissions and exclude no more than 10% of total emissions.

3. Set target boundaries

When setting target boundaries, parent companies should consider subsidiary emissions that are within their specific boundary consolidation approach.

Make sure the organizational boundary used is the same year-over-year and that it aligns with the company’s financial accounting and reporting procedures.

4. Determine what activities and associated emissions are included in the target

Review your GHG inventory in full to determine areas to prioritize based on the weight of emissions within each scope or emissions category.

If scope 3 emissions make up 40% or more of total emissions, set an emissions reduction or supplier SBTs target that covers at least 67% of total scope 3 emissions. For more information on how to set these targets, visit SBTi’s Scope 3 Guide and Case Study on Salesforce.

5. Choose a target year for your near- and long-term targets (as defined above in the “What does net zero mean” section)

For example, a near-term target year could be 2030 and a long-term target year should be no later than 2050.

6. Select a target-setting method

Below, we highlight a few approaches to selecting a target-setting method, and more methods can be found in Annex B of the Standard:

Cross-sector absolute reduction

Reduces absolute emissions consistent with the cross-sector pathway.

Requirements:

- Year-over-year reduction rate of 4.2% for scope 1 and 2, and 2.5% for scope 3

- Long-term reduction rate for overall emissions is a minimum of 90%

Sector-specific absolute reduction

Reduces absolute emissions consistent with a sector-specific pathway.

Requirements:

- Long-term reduction rate of 72% in agriculture sector

- Long-term reduction rate of 90% for power, cement, steel and buildings sectors

Sector-specific intensity convergence

Reduces emissions intensity, based on emissions per sector-specific outputs.

Requirements:

- Near-term target based on Sectoral Decarbonization Approach (SDA) formula

- Long-term target based on sector’s emissions intensity in 2050

Renewable energy

Alternative to scope 2 emissions reduction targets.

Requirements:

- At least 80% renewable electricity by 2025 and 100% by 2030, using renewable energy certificates (RECs) or virtual power purchase agreements (vPPAs)

7. Calculate near and long-term science-based targets

Use SBTi’s Corporate Near-Term Tool to calculate near-term targets and its Corporate Net-Zero Tool to calculate net-zero targets.

Example: A Cement company uses the Sectoral Decarbonization Approach for its near-term target. Using the Near-Term tool, it inputs base year emissions (in metric tons of CO2) and base year activity output (in metric tons of cement), then selects its target year and type of activity projection (either fixed market share or target year output). Because this Cement company anticipates a growth rate higher than the global rate associated with this pathway, it chooses the target year output option and provides the tons of Cement it expects to produce by the target year. This tool will then display the company’s target year emissions (tCO2), emissions intensity (tCO2/t of Cement), and reduction percentages.

Companies that commit to and set science-based targets are well aligned with upcoming regulations and supplier requirements. ADEC ESG can help companies prepare for future commitment and targets submission, offering services in GHG inventory and science-based target development:

- Read about how a global restaurant operator tackled GHG emissions management and science-based targets.

- Explore a real estate investment company’s journey to SBTi approval and third-party verified GHG inventory management.

This blog provides general information and does not constitute the rendering of legal, economic, business, or other professional services or advice. Consult with your advisors regarding the applicability of this content to your specific circumstances.