On March 6, the U.S. Securities and Exchange Commission (SEC) finalized rules to standardize climate-related disclosures by publicly traded companies. The much-anticipated ruling differs significantly from its original draft iteration, with more limited requirements compared to similar legislation that has recently come into force in California and the EU.

One of the notable changes is that Scope 3 emissions are no longer mandatory for any organization, and scope 1 and 2 emissions reporting requirements will apply only to certain groups of filers, if emissions-related risks are deemed financially material. Additional time is also given to comply with certain requirements—for example, while GHG emissions reporting is expected as early as FY2026, limited assurance is not required until FY2029, and reasonable assurance (which is only mandatory for large accelerated filers) is not required until FY2033. In addition, the final SEC Climate Rule only requires registrants to disclose climate-related information if they have developed the relevant assessment, plan, target, etc. For example, the rule only requires disclosure of a scenario analysis or transition plan if a registrant has completed the analysis or adopted a plan.

Overall the SEC Climate Rule has a less prescriptive approach to items including to climate-related risk disclosure, board oversight disclosure, and risk management disclosure requirements. The rule also does not include any specific penalties or fines for non-compliance, and instead only references the general enforcement powers of the Securities and Exchange Commission overall. Moreover, the SEC Climate Rule includes Safe Harbor provisions that will help safeguard companies against potential climate-related misstatements.

Regardless of the reductions in the level of requirements, the Climate Rule is a still an important step for the SEC in terms of ESG disclosure, and it marks the first time a U.S. federal agency has imposed mandatory climate-related disclosures on publicly traded companies within the U.S.

In this post, we’ll review the fundamentals of the SEC’s new Climate Rule: the who, what, when, and where of the rule—and what it may mean for your organization.

To whom does the SEC Climate Rule apply?

The rule applies to all publicly traded companies who file with the SEC. This includes both domestic and foreign issuers. It is essential that companies take steps to comply with the rule if they are any of the following as defined by the SEC: Large Accelerated Filers, Accelerated Filers, Small Reporting Companies, Emerging Growth Companies, or Small Reporting Companies.

The SEC estimates that about 2,800 U.S. companies and 540 foreign companies will be required to make these mandatory disclosures.

What information does the rule ask for?

The SEC Climate Rule asks firms to disclose information in the following seven categories:

Climate risk impact

Companies are expected to report on the effect of material climate risks in their financial statements. This information should inform investors on the company’s use of scenario analysis to identify and manage material climate risks. For investors who view scenario analysis as an important tool for risk management, these disclosures will allow them to factor this information into their decision-making process.

Unlike the CSRD, which was written with an emphasis on double materiality, the SEC Climate Rule focuses on financial (single) materiality or in other words climate-risks to a company’s bottom line.

Mitigation and adaptation

Companies must disclose:

- Any activities to that have been adopted to mitigate or adapt to a material climate-related risk, including the use of emissions targets, transition plan, or internal carbon prices.

- Any processes that the company has for identifying, assessing, and managing material climate-related risks.

- How these processes are integrated into the company’s overall risk management system or processes.

Board oversight and risk management

Reporting companies are required to disclose any oversight by the board of directors of climate-related risks. They must also disclose any role that management plays in assessing and managing material climate-related risks.

Climate goals

If a company has any climate-related goals or targets, information about these must also be disclosed. More specifically, goals or targets that have affected or are likely to affect the registrant’s overall business, results of operations, or financial condition must be disclosed. This includes actions taken or expenditures made to make progress toward meeting goals.

Scope 1 and 2 disclosures

Scope 1 and 2 disclosures are only required for large accelerated filers (LAFs) and accelerated filers (AFs), if the company considers emissions-related risks to be material.

Starting in FY2029, if a company is disclosing on scope 1 and 2 emissions, an assurance report at the limited assurance level will also be required. For LAFs, this report will need to be at the reasonable assurance level by FY2033 (see section below for a full timeline).

Severe weather events

Subject to applicable thresholds, companies are required to disclose the costs, expenditures, charges, and losses incurred as a result of severe weather events and other natural conditions that the company is currently experiencing, such as:

- Hurricanes

- Tornadoes

- Flooding

- Drought

- Wildfires

- Extreme temperatures

- Sea level rise

In addition, if financial impacts from the above conditions or related to climate transitions were estimated, the reporting company must provide a description of the impacts and describe how the estimates were developed.

Carbon offsets and RECs

If a company utilizes carbon offsets and renewable energy credits/certificates (RECs) as a part of its plans to achieve climate goals or targets? Any costs, expenditures, and losses related to these offsets and RECs must be disclosed.

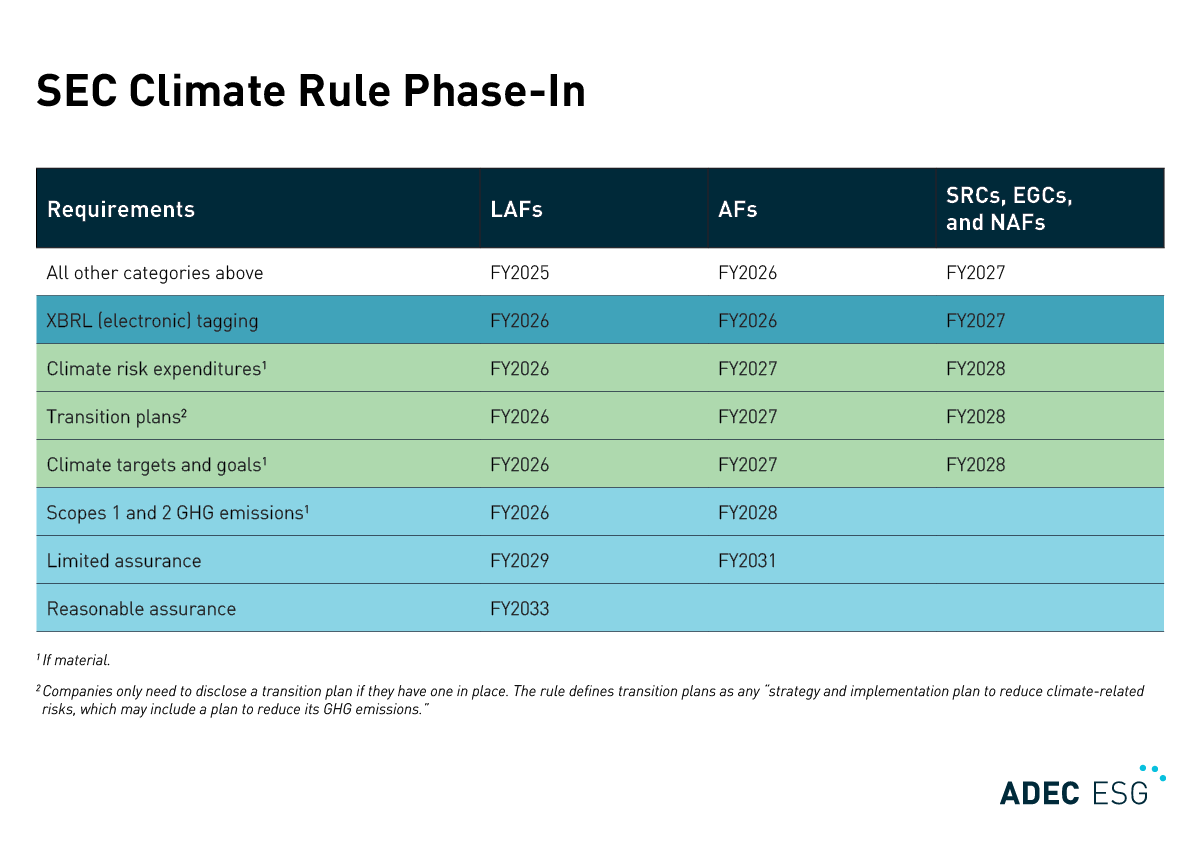

When must companies comply with the Climate Rule?

The SEC will be phasing in its final Climate Rule over the next several years, with some reporting required as early as FY2025. Timelines vary between types of reporting companies, grouped into the following categories:

- Large accelerated filers (LAFs)

- Accelerated filers (AFs)

- Small reporting companies (SRCs), emerging growth companies (EGCs), and non-accelerated filers (NAFs)

An at-a-glance summary of the phase-in period is illustrated below.

Where will companies be expected to disclose?

The SEC Climate Rule creates a new subpart (1500) within already existing Regulation S-K and Article 14 of Regulation S-X. Companies should file their climate-related disclosures in their registration statements and Exchange Act annual reports.

Climate-related disclosures under Regulation S-K* should be in a separate or relevant section, appropriately captioned and/or electronically tagged. The Climate Rule also includes provisions on where scope 1 and 2 GHG emissions information should be disclosed, including in annual reports (Form 10-K, Form 20-F) and certain quarterly reports (Form 10-Q).

What does the SEC’s Climate Rule mean for your company?

While there has been significant discussion on the legal challenges this law will face, companies would be wise to continue to prepare for compliance with this law, as most SEC agency actions survive review under the APA, even in unfriendly circuits.

In the context of other mandatory sustainability disclosures, the SEC Climate Rule has far fewer provisions than the Corporate Sustainability Reporting Directive (CSRD) in Europe or the California Climate Accountability Package (California SB261 and SB253). With the removal of scope 3 emissions and a significantly reduced reporting burden on scope 1 and 2, there are significantly fewer quantitative disclosures required as part of this new legislation.

It is also key to note that the SEC has not followed the EU’s example on defining materiality through the lens of double materiality, instead focusing on single materiality or financial materiality to companies under short-, medium- and long-term time horizons. The inclusion of transition plans and scenario analysis is also only mandatory if a company has previously disclosed this information in other public documents or reporting mechanisms, such as CDP reporting, annual reports, or sustainability reports. This is largely due to the SEC’s focus on reducing administrative burden on companies unable to compile this data.

SEC Chair Gary Gensler has pointed out that compliance with this SEC Climate Rule does not protect companies from having to comply with other countries or jurisdictions mandatory climate disclosure legislation if their company falls under that legislation’s applicable scope. He specifically referenced the European Union’s CSRD and California’s SB261 and SB253 regulations. As many large accelerated filers in the U.S. also tend to fall into scope for the CSRD, SB261, and SB253, they would be wise to keep in mind that merely complying with the SEC requirements will not prepare them for California’s or the EU’s climate disclosure laws. Additionally, some climate-related disclosures required by these other jurisdictions will iteratively trigger a company to have to disclose the same information within the SEC framework (e.g., scenario analysis).

To support companies as they work to comply with any ESG regulatory action—whether that’s the SEC’s new Climate Rule, California’s SB261 and SB253, the EU’s CSRD, or other international legislation—ADEC ESG offers a suite of fully customizable services, including:

- Regulatory Review and Roadmap Service

- Materiality Review

- Scenario Analysis (includes physical and transition risk assessment)

- GHG Verification

- Transition Plan

- Risk Monitoring

ADEC ESG Solutions provides fully-integrated industry expertise, software solutions, and data management to organizations leading global, sustainable change. Our expert technical teams help companies around the world develop sustainability strategies, manage their ESG data, and report on their progress. Talk to us today to learn more about how we can help your company meet its ESG goals.

*Regulation S-K focuses on most of the new items added through this additional climate rule, including but not limited to definitions of Climate Related Risks and Opportunities, Time Horizons and Materiality Determination, Impacts of Climate-Related Risks on Strategy, Business Model and Outlook, Transition Plan Disclosures (if used), Disclosure of Scenario Analysis (if used), Disclosure of a Maintained Internal Carbon Price, Governance Disclosure, Targets and Goals Disclosure, GHG Emissions Disclosure, Attestation on GHG Emissions Disclosure, GHG Emissions Attestation Provider Requirements, and Additional Disclosure by the Registrant, Safe Harbor for Certain Climate-Related Disclosures, Financial Statements Effects, Expenditure Effects, Financial Estimates and Assumptions, Opportunities, Financial Statement Disclosure Requirements, and Structured Data Requirement.